Author | Bonnie Treichel

Many loosely throw around the term “fiduciary governance.” Just like the similarly broad “financial wellness,” it can take on a lot of meanings – some more useful than others. In this context, fiduciary governance means a repeatable framework that plan sponsors can use to meet their fiduciary obligations related to the retirement plan, including the documentation to support such a framework. At the end of 2023, a district court judge in Nunez v. B. Braun Medical, Inc. issued an opinion that showcases why a governance framework is so important.

Remember, the Employee Retirement Income Security Act (ERISA) is all about the process and not necessarily the outcome.

Here’s What You Really Need to Know:

- Lowest share class is not necessarily mandatory. In the Nunez case where defendant plan fiduciaries prevailed, the lowest share class did not result in the lowest net plan fees.

- ERISA does not require fiduciaries to select the lowest cost service provider. Instead, the Nunez court rewarded plan fiduciaries that selected a slightly higher priced recordkeeper because the plan fiduciaries could demonstrate a prudent process and the expectation of higher value service from the selected recordkeeper.

- Maintaining evidence in meeting minutes of the process that was followed by plan fiduciaries, including evidence that the committee discussed share classes and recordkeeping fees, will provide a strong defense in the event of future litigation.

Let’s Dive In…

Background

Under ERISA, plan fiduciaries have five core obligations:

- Acting solely in the interest of plan participants and their beneficiaries and with the exclusive purpose of providing benefits to them;

- Carrying out their duties prudently;

- Following the plan documents (unless inconsistent with ERISA);

- Diversifying plan investments; and

- Paying only reasonable plan expenses.

These core responsibilities are intertwined and may sometimes appear to be at odds with one another. For example, consider the relationship between the obligation to pay only a reasonable fee for recordkeeping services and the availability of proprietary investment options that might reduce the recordkeeping fee (but possibly not be the most prudent and/or lowest cost investment options). Moreover, fiduciaries bare several responsibilities beyond the core obligations described above, including but not limited to the obligation to locate missing participants and to evaluate service providers’ cybersecurity protections.

For plan fiduciaries, there is no short cut. The duty to select and monitor service providers should remain a distinct prudent process from the duty to prudently select and monitor investments. Each process should be well documented and should remain independent, even when short cuts may tempt fiduciaries with so many responsibilities now on their plate.

Case of Nunez v. B. Braun Medical, Inc.

Following a bench trial in August 2023, a district court in Pennsylvania dismissed the case of Nunez v. B. Braun Medical, Inc., finding that the defendant plan fiduciaries/committee did not breach its duty of prudence. The court found:

- The plan fiduciaries had a process in place to monitor investments and that the investments were prudent.

- The plan fiduciaries had a process in place to select, monitor, and replace the recordkeeper, as well as to negotiate recordkeeping fees.

Specifically, the plan fiduciaries took actions and had strong documentation that provided a strong set of exhibits to include in their defense. Regarding investments, the plan fiduciaries, in the words of the court, took and documented the following steps:

- “The Committee met regularly to evaluate the Plan’s investment options.”

- “The Committee relied on advisors and watchlists to ensure that the Plan’s investment options were not underperforming, even voting to remove funds that were.”

- “The Committee demonstrably considered making changes to the Plan such as moving funds to lower-fee share classes and adopting CITs, choosing or not choosing to make such changes at various times throughout the Class Period upon a balance of considerations.” For example, here, there were instances when the plan did not use the lowest share class or a collective investment trust (CIT), but the court was persuaded by the process of considering these options and demonstrating the thoughtfulness of the process. The court emphasized that the committee discussed share classes at 11 different meetings during the period at issue.

Regarding recordkeeper selection and monitoring, in the words of the court:

- “The Committee clearly negotiated down the Plan’s recordkeeping fees per participant on numerous occasions.”

- “The Committee also regularly utilized third-party consultants to benchmark the Plan’s recordkeeping fees, only one of which concluded that the Plan’s fees were higher than usual, which itself resulted in the Committees negotiating a reduction in fees.”

- “When it came to fee leveling, the Committee transitioned the Plan to such an arrangement within a year of it becoming available and at a time when fee leveling was becoming more popular in the industry.”

- “The Committee conducted an RFP during which it ranked seven options by taking into account a variety of considerations, ultimately choosing a company that ranked highest by almost every metric.” Though highest by almost every metric, the company selected also was not the cheapest option. The court did not require the plan fiduciaries to select the cheapest option but instead required a deliberative process and evidence of that process.

A Note on District Courts

There are three layers to the federal court system, beginning with the district courts. Cases advance to the two higher levels – the Courts of Appeals and the Supreme Court – only when those courts agree to consider an appeal of a lower court decision. Although a district court opinion does not bind other courts, the Nunez case is important because: (1) many retirement plan fee lawsuits are dismissed or settled before a trial; (2) as a result, there are few ERISA litigation opinions that reflect full consideration of evidence offered by both parties; and (3) many district courts look to other courts’ opinions for persuasive value, even if not binding.

Action Items for Plan Sponsors

As a plan fiduciary, consider these action items as a good defense to litigation, as well as strong documentation in the event of an encounter with the Department of Labor, which can happen with plans of all sizes:

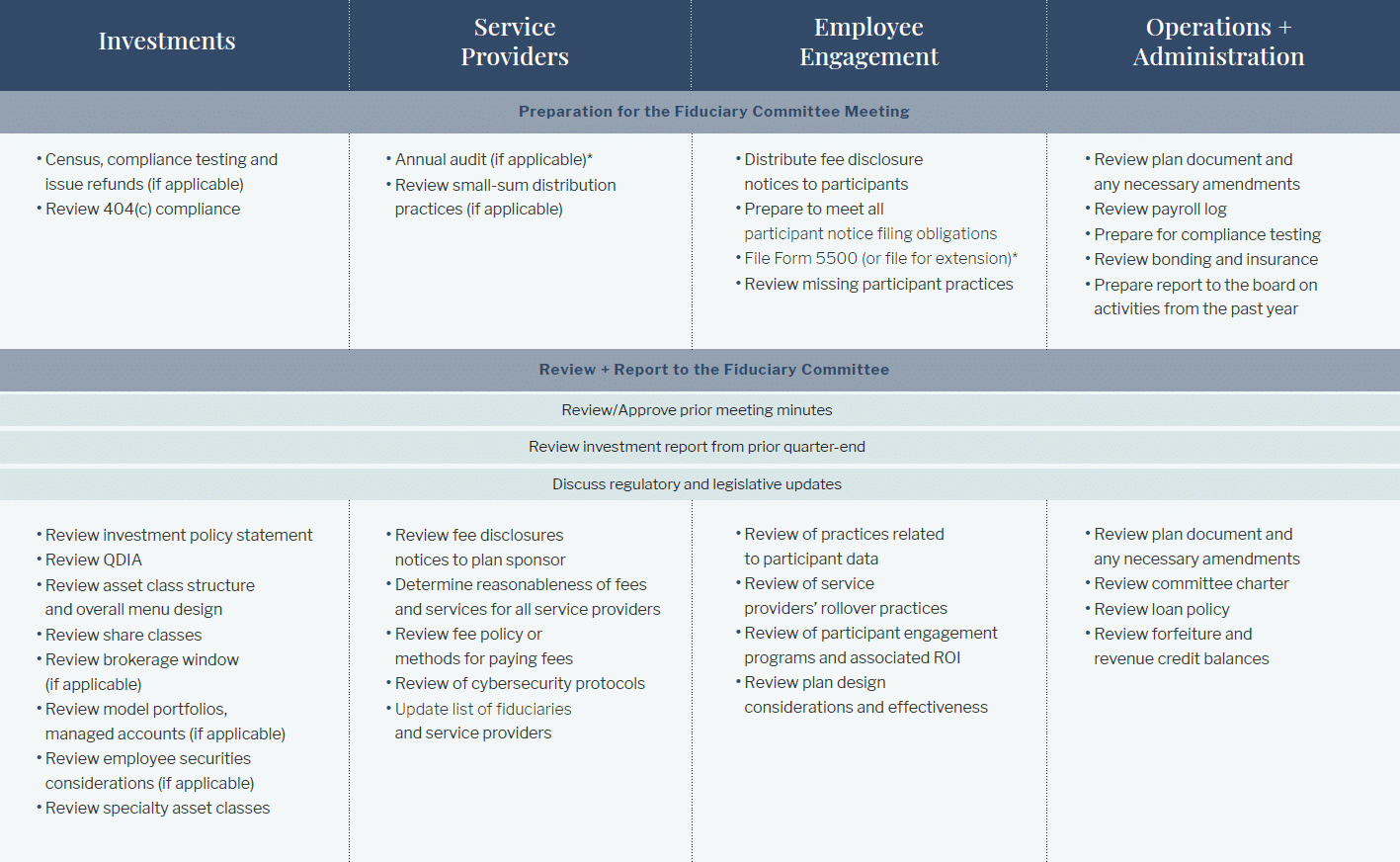

- Implement an ongoing governance calendar to ensure fiduciaries are meeting all areas of fiduciary responsibility.

- Determine who is responsible for all areas of fiduciary responsibility; when necessary, hire outside experts to assist.

- Meet on a regular cadence and document such meetings, regardless of the number of people going through the process.

- Engage in proactive, ongoing fiduciary training to ensure all parties understand their obligations related to the plan.

To learn more, work with a knowledgeable retirement plan advisor or consultant to get started working through the governance framework.